Introduction

Within collateral documentation, it is common to detail what assets you will exchange with your counterparties, i.e., what you deem eligible collateral. Such information is found in bilateral legal document, custodian triparty agreements and is also used for other purposes where defining whether an asset is eligible to be used as collateral to mitigate risk on a defined set (portfolio) of financial instruments between parties.

Data requirements to represent eligible collateral include common information such as, asset descriptors e.g. who issues the asset, the asset type, its maturity profile, any related agency credit risk rating, and if any collateral haircut is to be applied to the asset's value.

Within legal collateral documents, the definition of eligible collateral can take several forms; some may want to list assets and the related eligibility information in table-format using common language, use textual description of types of eligible assets, or use common identifiers and taxonomies. However, it is evident for each method chosen there is no common data standard to express the same information for all the data attributes used.

The financial crisis and the resulting regulatory framework that emerged from guidelines outlined under BCBS/IOSCO and Basel III has presented further requirements that define specific criteria for collateral eligibility that must be applied to portfolios. Observation of different regulations under various jurisdictions has presented several challenges for defining collateral asset economic identity, correct categorisation and application of specified haircuts and concentration limits. Having no common standards in place to represent the key data has led to lengthy negotiation, misinterpretation, lack of interoperability and downstream operational inefficiency.

Eligible Collateral in the CDM

The CDM provides a standard digital representation of the data required to express collateral eligibility for purposes such as representation in legal agreements that govern transactions and workflows. The benefits of this digital representation are summarized below:

- Provides a comprehensive digital representation to support the data requirements to universally identify collateral types.

- Includes ability to identify attributes of collateral that contribute to the risk like the type of asset, interest structures, economics, embedded options and unique characteristics.

- Uses data standards to specify eligibility related information such as haircuts (regulatory credit quality, FX related or additional haircuts), agency or composite credit ratings and asset maturity terms

- Provides functions to apply treatment rules to predefined collateral criteria such as include/exclude logic

- Applies treatment rules for concentration limits caps by percentage or value. These can be applied to one or multiple elements of the collateral characteristics and defined criteria

- Attributes are included to identify regulatory rules by defined eligibility identification categories published by regulatory bodies such as EMIR, CFTC and US Prudential

- Provides a means of Identifying Schedules and constructing reusable collateral profiles

- Standardises digital data representation components to construct the details to identify collateral eligibility not just for regulatory purposes but for all needs of eligibility expression within legal contracts and documentation

- Promotes a standard format to represent eligible collateral for negotiators to identify and agree details without misinterpretation

- Provides standards to facilitate Interoperability between platforms for digitised eligible collateral information

- Connects contractual terms of eligibility in documentation to supporting processes

- Standardises data records for audit requirements

- Provides many opportunities in the collateral ecosystem and benefits a data representation of collateral choices that can be imported and exported to other systems such as credit, treasury, trade reporting and custodian platforms, providing a full workflow solution from negotiation, execution through to optimisation and settlement.

Modelling Approach

Scope

The model's primary intention is to deliver standards for OTC Derivatives with a focus on uncleared margin rules. In addition, the approach is intended to also be used to express collateral eligibility for other industry workflows such as Securities Lending, Repo and Exchange Traded Derivatives (ETD). The model foundations, broad range of attributes and functions has been constructed with this in mind and can be extended further to operate to wider processes.

The common data requirements have been established through industry working groups reviewing a wide range of examples in order to identify collateral for the purpose of constructing eligible collateral specifications, including representation of additional attributes for regulatory risk and credit factors. For the purpose of understanding the principle, these can be divided into the following categories:

- Issuer Identification

- Asset Identification

- Collateral Haircuts

- Maturity Ranges

- Concentrations Limits

- Treatments Functions

The data attributes within the model provides the flexibility to firstly identify the collateral issuer and asset class, then define its maturity if relevant, then apply treatment rules for any chosen haircut percentages, concentration limits and inclusion or exclusion conditions. The combination of these terms allows a wide range of collateral and associated data for eligibility to be represented.

Approach to identifying Collateral Assets

The universe of collateral used throughout the industry for risk mitigation purposes is vast and the intention is for the CDM to provide a standard means of identifying as much of this collateral universe as possible initially and then extend the model further as required via open-source contributions under the CDM governance structure.

At the outset, there have been no common standards for describing collateral; the foundational structure in the CDM provides a means to identify a majority of collateral issuers and covers a wide range of asset types that are commonly seen in eligible collateral data.

The approach in the CDM is to adopt a similar method to the 'Animal Kingdom' tree and taxonomy (kingdom → phylum → class → order→ family → genus → species) -- i.e., that there is one method for describing any of the core attributes of an "animal" (i.e., type of issuer/type of asset/type of economic terms) that need to be referenced, but only one way. Each issuer type, asset type, economic type etc has a unique place in the universe of collateral but is logically grouped together with similar types.

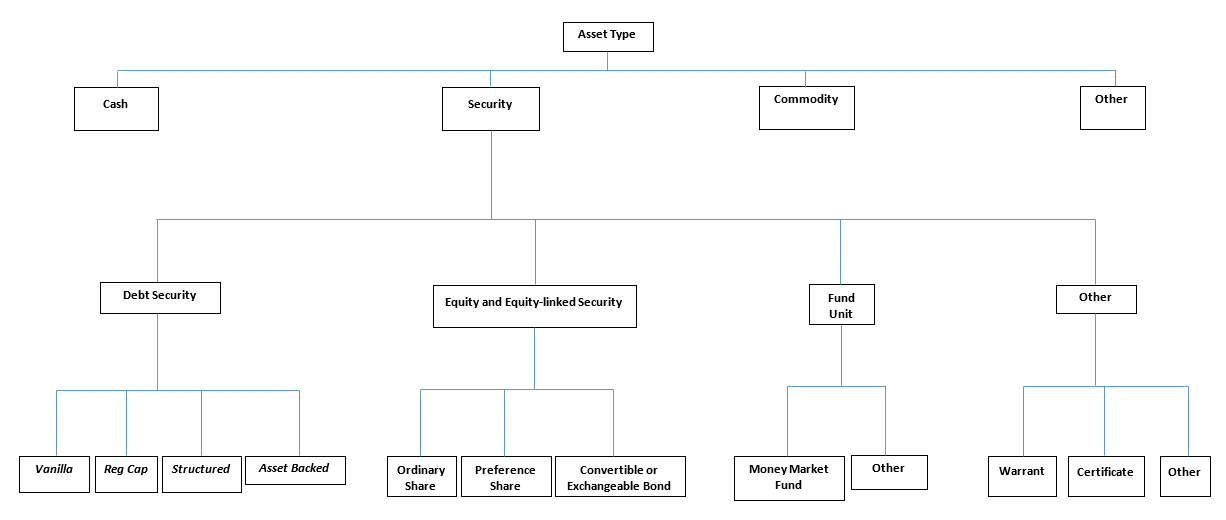

An illustrative example for understanding the principle is shown here:

The CDM method for representing eligible collateral will be capable of reference to, and inclusion in, common master and respective collateral documentation for OTC Derivatives and non- OTC master agreements (notably Repo and Securities Lending) and potentially for OTC Cleared and Exchange Traded Derivatives. For this reason, it is important that the CDM is able to accommodate Regulatory Uncleared Margin Rules concepts that are relevant but the model should not prescribed by them.

Although the industry will benefit from using a digital standard to describe collateral, there is also a need to recognise that market participants may want to identify eligible collateral without fully describing every feature and instead use industry identifiers, where available. Thus, the CDM also provides a means that collateral issuers can be identified using common legal entity identifiers such as an LEI. Similarly, asset types can be identified using a product ID such as ISIN or CUSIP or a standard taxonomy source.

High Level Design Principles

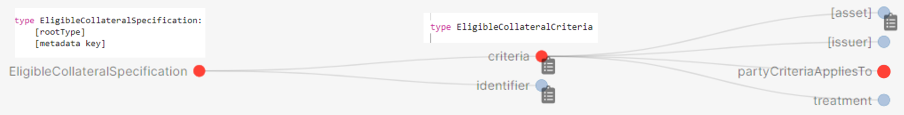

The foundational data structure from the highest level allows firstly to represent eligibility through specification of criteria:

The Asset type is used to specify criteria related to the nature of the asset, such as its type (cash, debt, equity, or other), its country of origin or its denominated currency.

The Issuer type is used to specify criteria related to the issuer of the asset, such the type of issuer (government, corporate, etc), specific issuer name, or agency rating

Treatment is used to specify the valuation percentage, any concentration limits and or specific inclusion or exclusion conditions, which additionally apply to filter whether a piece of collateral is eligible or not.

The combination of these terms allows a wide variety of eligible collateral types to be represented and a structure can be used to identify individual collateral types or a group of collateral assets for inclusion in specifying eligible collateral schedule details.

Identifying Eligible Collateral using the CDM Data Structure

A combination of data types can be used to describe the collateral

asset, its origin and its issuer. Data type EligibleCollateralCriteria

extends CollateralCriteriaBase and contains data types to enable to

define collateral Asset and Issuer characterises

Asset Criteria

The data type AssetCriteria is used to specify the definition of the

collateral asset, this includes the following data attributes:

type AssetCriteria:

collateralAssetType AssetType (0..*)

assetCountryOfOrigin ISOCountryCodeEnum (0..*)

denominatedCurrency CurrencyCodeEnum (0..*)

agencyRating AgencyRatingCriteria (0..*)

maturityType MaturityTypeEnum (0..1)

maturityRange PeriodRange (0..1)

productIdentifier ProductIdentifier (0..*)

collateralTaxonomy CollateralTaxonomy (0..*)

domesticCurrencyIssued boolean (0..1)

listing ListingType (0..1)

condition AssetCriteriaChoice:

optional choice collateralAssetType, collateralTaxonomy, productIdentifier

collateralAssetTypeRepresents a filter based on the asset product type.collateralAssetTypeRepresents a filter based on the asset product type.assetCountryOfOriginRepresents a filter based on the issuing entity country of origin.denominatedCurrencyRepresents a filter based on the underlying asset denominated currency.agencyRatingRepresents an agency rating based on default risk and creditors claim in event of default associated with specific instrument.maturityTypeSpecifies whether the maturity range is the remaining or original maturity.maturityRangeRepresents a filter based on the underlying asset maturity.productIdentifierRepresents a filter based on specific instrument identifiers (e.g. specific ISINs, CUSIPs etc)collateralTaxonomySpecifies the collateral taxonomy, which is composed of a taxonomy value and a taxonomy source.domesticCurrencyIssuedIdentifies that the Security must be denominated in the domestic currency of the issuer.ListingTypeSpecifies the exchange, index or sector specific to listing of a security.

Each of the AssetCriteria data attributes in the model provides

further granularity to describe the asset, either as basic types or

complex types, for example:

collateralAssetTypecan be used to define further byAssetTypesuch assecurityType,debtType,equityType, orfundType. Each of these can be used to represent data in further granularity if required providing more enumeration options. These are covered in further examples throughout this guide.assetCountryOfOriginanddenominatedCurrencyare 'string' basic types and can be populated by a country name, code or currency abbreviations.domesticCurrencyIssuedis a Boolean data attribute option to specify True or False.AgencyRatingCriteriaand maturityType are explained in more detail in further examples throughout this guide.

Issuer Criteria

The data type IssuerCriteria is used to specify the issuer of a

collateral asset, this includes the following data attributes:

type IssuerCriteria:

issuerType CollateralIssuerType (0..*)

issuerCountryOfOrigin ISOCountryCodeEnum (0..*)

issuerName LegalEntity (0..*)

issuerAgencyRating AgencyRatingCriteria (0..*)

sovereignAgencyRating AgencyRatingCriteria (0..*)

counterpartyOwnIssuePermitted boolean (0..1)

issuerTypeRepresents a filter based on the type of entity issuing the asset.issuerCountryOfOriginRepresents a filter based on the issuing entity country of origin, which is the same as filtering by eligible Sovereigns.issuerNameSpecifies the issuing entity name or LEI.issuerAgencyRatingRepresents an agency rating based on default risk and creditors claim in event of default associated with asset issuer.sovereignAgencyRatingRepresents an agency rating based on default risk of country.counterpartyOwnIssuePermittedRepresents a filter based on whether it is permitted for the underlying asset to be issued by the posting entity or part of their corporate family.

For each of the IssuerCriteria options, the model will provide further

options of granularity; for example issuerType will allow you to

define further express data for the detail to be more specific to the

type of issuer for example: SovereignCentralBank, QuasiGovernment,

RegionalGovernment and so on., If necessary, each will offer further

levels of granularity relevant to each issuer type. These will be

covered in more detail and in further examples throughout this guide.

Other attributes of IssuerCriteria can be used and added to your

issuer description, if required, and will give various levels of

granularity dependent on their nature and purpose in describing the

issuer. For example issuerCountryOfOrigin is a free format 'string'

representation to be populated by a country name, code.

counterpartyOwnIssuePermitted is a Boolean data option to specify Y/N.

issuerName is used to express a legal entity id as a 'string'.

Whereas, other attributes will have more detailed options such as

IssuerAgencyRating These will be covered in more detail and in further

examples throughout this guide.

Treatment Functions

Treatment rules can be applied to eligible collateral in several ways

using data type CollateralTreatment which specifies the treatment

terms for the eligible collateral criteria specified . This includes a

number of options which are listed below:

ValuationTreatmentSpecification of the valuation treatment for the specified collateral, such as haircuts percentages.concentrationLimitSpecification of concentration limits applicable to the collateral criteria.isIncludedA boolean attribute to specify whether collateral criteria are inclusion (True) or exclusion (False) criteria.

The CDM model is flexible so that these treatment rules can be applied to the detail of data expression for eligible collateral on an individual basis or across a group of issuer names or asset types or combinations of both. Each treatment function will have its own set of options and the model will provide further options of granularity.

Valuation Treatments

CollateralValuationTreatment will allow for representation of

different types of haircuts, as follows . Please note: data expression

for percentages is a number with a condition to be expressed as a

decimal between 0 and 1.

haircutPercentageSpecifies a haircut percentage to be applied to the value of asset and used as a discount factor to the value of the collateral asset, expressed as a percentage in decimal terms.marginPercentageSpecifies a percentage value of transaction needing to be posted as collateral expressed as a valuation.fxHaircutPercentageSpecifies an FX haircut applied to a specific asset which is agreed between the parties.AdditionalHaircutPercentageSpecifies a percentage value of any additional haircut to be applied to a collateral asset, the percentage value is expressed as the discount haircut to the value of the collateral.

Concentration Limits

ConcentrationLimit,is another form of treatment which has a set of

attributes which allow concentration limits to be defined in two

alternative ways using ConcentrationLimitCriteria

Generic method : If you wish to apply a concentration limit to a set

of pre-defined eligible collateral details in the CDM, you would use

ConcentrationLimitType, ConcentrationLimitTypeEnum which allows you

to define which existing details to apply the concentration limit to

from an enumeration list including (Asset, Base currency, Issuer,

Primary Exchange, Sector.. etc)

Specific method : If you wish to apply a concentration limit to a

specific asset or issuer of asset, you would use the

ConcentrationLimitCriteria. This extends CollateralCriteriaBase and

allows you be more specific using the granular structures of the

IssuerCriteria and AssetCriteria to specify the details of the

issuer or asset you want to apply the concentration limit.

In addition, you would need to specify the form of the Concentration limit being used as a value limit range to apply a cap (upper bound) or floor (lower bound) to the identified asset, issuer or attributes. There are two options that allow this to be represented in value or percentage terms as follows:

type ConcentrationLimit:

concentrationLimitCriteria ConcentrationLimitCriteria (0..*)

valueLimit MoneyRange (0..1)

percentageLimit NumberRange (0..1)

ValueLimitSpecifies the value of collateral limit represented as a rangepercentageLimitSpecifies the percentage of collateral limit represented as a decimal number

There are conditions in the CDM when applying concentration limits that constrain choices to:

- one of the concentration limit methods (either a limit type or limit criteria must be specified)

- one concentration limit type (either a value limit or percentage limit concentration must be specified)

Inclusion Rules

The collateral treatment function isIncluded can be used as a

treatment term for the eligible collateral criteria specified and

indicate if the collateral is eligible or not. Therefore a Boolean data

attribute is applied using one of the following:

- (True) Collateral Inclusion

- (False) Collateral Exclusion

Additional Granular Information for Eligible Collateral Data Construction

The CDM data structure to express collateral eligibility has been

explored in more detail and it has been demonstrated where the

EligibleCollateralCriteria can be broken down into data related to

IssuerCriteria and AssetCriteria and rules can be applied using data

for CollateralTreatment.

The following section focuses on the more granular details of the

various data attributes available through IssuerCriteria and

AssetCriteria.

Collateral Asset and Issuer Types

Under data types for both IssuerCriteria and AssetCriteria the first

data attributes available to detail collateral are issuerType and

collateralAssetType these will offer additional data.

Defining Collateral Issuers:

issuerType allows for multiple expressions of data related to the

issuer using CollateralIssuerType containing data attributes as

follows:

issuerType IssuerTypeEnum Specifies the origin of entity issuing the

collateral with the following enumerations shown as examples but not

limited to:

- SupraNational

- SovereignCentralBank

- RegionalGovernment

- Corporate

Some attributes are extended to allow further granularity as shown in the examples below:

supraNationalType Represents types of supranational entity issuing the

asset, such as international organisations and multilateral banks --

with enumerations to define:

- InternationalOrganisation

- MultilateralBank

Defining Collateral Assets:

collateralAssetType allows for multiple expressions of data related to

the collateral asset using AssetType which has further data attributes

as follows:

assetType - Represents the type of collateral asset with data attributes as enumerations to define

- Security

- Cash

- Commodity

- Other Collateral Products

securityType - Represents the type of security with data attributes to

define, as examples:

- Debt

- Equity

- Fund

debtType - Represents a filter based on the type of bond which

includes further optional granularity for certain characteristics that

may be required to define specific details related to debt type assets

such but not limited to as follows:

- DebtClass

- Asset Backed

- Convertible

- RegCap

- Structured

- DebtEconomics

- Debt Seniority

- Secured

- Senior

- Subordinated

- Debt Interest

- Fixed

- Floating

- Inflation Linked

- Debt Principal

- Bullet

- Callable

- Puttable

- Amortising

- Debt Seniority

A similar structure exists for equityType and fundType and other

collateral assets types.

As well as defining the details of the asset and issuer of collateral using the various attributes available in the CDM description tree, there are other detailed criteria that may be required to define collateral and for use in expressing eligibility details; the guide will detail these and indicate the data structure available to define them.

Agency Ratings Criteria (Used within both Issuer and Asset Criteria)

The use of specifying agency rating criteria for credit purposes can be useful for many means in legal documentation to drive operational outcomes such as collateral thresholds and event triggers. When defining collateral eligibility, the CDM can represent collateral underlying credit default risk in various ways by using agency rating sources. These are useful and common for determining eligible collateral between parties and those defined under regulatory rules for posting certain margin types.

The model components are specified in the CDM using data type

AgencyRatingCriteria : - Represents class to specify multiple credit

notations alongside a conditional 'any' or 'all' qualifier.

For the purpose of use in defining eligible collateral this can be applied to the following data attributes:

IssuerCriteria>issuerAgencyRating- Represents an agency rating based on default risk and creditors claim in event of default associated with asset issuerIssuerCriteria>sovereignAgencyRating- Represents an agency rating based on default risk of the country of the issuerAssetCriteria>agencyRating- Represents an agency rating based on default risk and creditors claim in event of default associated with specific instrument

Data type AgencyRatingCriteria Allows specification of the following

related information to eligible collateral

type AgencyRatingCriteria:

qualifier QuantifierEnum (1..1)

creditNotation CreditNotation (1..*)

mismatchResolution CreditNotationMismatchResolutionEnum (0..1)

referenceAgency CreditRatingAgencyEnum (0..1)

boundary CreditNotationBoundaryEnum (0..1)

qualifierIndicator for whether all or any of the agency ratings specified apply using the All or Any enumeration contained within QuantifierEnumcreditNotationIndicates the agency rating criteria specified for the asset or issuer. This expands to offer further granularity for details relating to the credit details

type CreditNotation:

agency CreditRatingAgencyEnum (1..1)

notation string (1..1)

[metadata scheme]

scale string (0..1)

[metadata scheme]

debt CreditRatingDebt (0..1)

outlook CreditRatingOutlookEnum (0..1)

creditWatch CreditRatingCreditWatchEnum (0..1)

CreditRatingAgencyEnumA list of enumerated values to specify the rating agency or agencies, (all major rating agencies are supported)notationSpecifies the credit rating notation. As itvaries among credit rating agencies, the CDM does not currently specify each specific rating listed by each agency. The data'string' allows the free format field to be populated with a rating , such as 'AAA'scaleSpecifies the credit rating scale, with a typical distinction between short term, long term. The data 'string' allows the free format field to be populated with a scale indicator such as 'long term', 'short term'.debtSpecifies the credit rating debt type is for any credit notation associated debt related credit attributes if needed. This gives the additional flexibility option to identify amongst the credit criteria debt characteristics such as (high yield, deposits, investments grade) The data type extends to offer two optionsdebtTypeThis attribute is free format 'string' and used when only one debt type is specifieddebtTypesThis allows you to specify for than one multiple debt type characteristics and has a qualifying conditions to specify if you wish to include 'All' or 'Any' of the elements listed in scope

outlookThis data attributes allows you to specify the a credit rating outlook assessment that is commonly determine by rating agencies. It is an indication of the potential direction of a long-term credit rating over the intermediate term, which is generally up to two years for investment grade and generally up to one year for speculative grade. The enumeration list allows you to specify if required one of the following outlook terminology- Positive (A rating may be raised)

- Negative (A rating may be lowered)

- Stable (A rating is not likely to change)

- Developing (A rating may be raised, lowered, or affirmed)

creditWatchSimilar to detailing a type of credit outlook, credit agencies will also identify individual credit by a means of a monitoring (watch) status for an undefined period. This watch status can be expressed using the following data terminology under this enumeration list.- Positive (A rating may be raised)

- Negative (A rating may be lowered)

- Developing (A rating may be raised, lowered, or affirmed)

mismatchResolutionIf several agency issue ratings are being specified that are not necessarily equivalent of each, this data attribute allows you to label which one has certain characteristics amongst the others, such as lowest or highest etc, the following enumerations are available:- Lowest

- Highest

- Reference Agency

- Average

- Second Best

enum CreditNotationMismatchResolutionEnum:

Lowest

Highest

ReferenceAgency

Average

SecondBest

referenceAgencyThis part of the agency rating criteria again allows you to specify from the list of enumerated values for the rating agency. But in this case it is to identify the rating agency if you need to determine one from others if you used the data attribute referenceAgency in theCreditNotationMismatchResolutionEnumas outlined above.boundaryIndicates the boundary of a credit agency rating i.e minimum or maximum.

A condition exists If the mismatch resolution choice is

ReferenceAgency, you must ensure that the reference agency is

specified through the CreditRatingAgencyEnum

For example:

Through CreditNotation the following data has been specified:

S&P AAA

Moodys Aaa

Fitch AAA

Then one of these needed to be specified as the dominant rating as an

example (Moodys), you would express mismatchResolution >

CreditNotationMismatchResolutionEnum > ReferenceAgency

referenceAgency > CreditRatingAgencyEnum > Moodys

Collateral Taxonomy (Used within Asset Criteria)

It is understood that data used to determine asset types used in specifying eligible collateral information can often refer to common structured standard pre-defined taxonomy sources. Although the purpose of the CDM is to encourage one standard representation of data for asset types, there are circumstances where assets are organised and labelled into categories, such as by regulators. In some circumstances, it may be a requirement to refer to these identifiable sources. In the CDM, these taxonomy sources can be referenced in a consistent representation.

The CDM allows the definition of, and reference to, certain taxonomy

sources to be used to express details for eligibility. These can be used

as an additional means of expressing asset types outside of the

descriptions tree or alongside it. Under data type AssetCriteria there

are data attributes to reference collateral related taxonomy sources as

follows:

Data Type collateralTaxonomy will allow for specification of the

collateral taxonomy, which is composed of a taxonomy value and a

taxonomy source.

- The data attribute

taxonomySourcemust be specified and will provide the following options through the enumerations list:- CFI (The ISO 10962 Classification of Financial Instruments code)

- ISDA (The ISDA product taxonomy)

- ICAD (ISDA Collateral Asset Definition Identifier code)

- EU EMIR Eligible Collateral Asset Class (European Union Eligible Collateral Assets classification categories based on EMIR Uncleared Margin Rules)

- UK EMIR Eligible Collateral Asset Class (UK EMIR Eligible Collateral Assets classification categories based on UK EMIR Uncleared Margin Rules)

- US CFTC PR Eligible Collateral Asset Class (US Eligible Collateral Assets classification categories based on Uncleared Margin Rules published by the CFTC and the US Prudential Regulators)

The options CFI, ISDA and ICAD would be further expressed with the

flexible data 'string' representation through data type

ProductTaxonomy.

However the regulatory 'Eligible Collateral Asset Class' rules have individual enumeration lists unique to their asset class categories identified under each of the respective regulatory bodies. Therefore if these are selected as taxonomy sources through TaxonomySourceEnum it is required to specify details from the related unlimited enumeration lists that exist under data type CollateralTaxonomyValue, these are shown below:

eu_EMIR_EligibleCollateraluk_EMIR_EligibleCollateralus_CFTC_PR_EligibleCollateralnonEnumeratedTaxonomyValue

Please note: The regime codes are not mandatory and are based on reference to the regulatory eligible categories, but do not qualify the regulations. The CDM only provides a standard data representation so that institutions can recognise the same information.

Each enumeration has a full description of what regulatory published

rules the list of eligible collateral assets classification

codes/categories are based on. Under each enumeration list there are a

number of categorised eligible asset groups which have been identified

under each set of regulatory rules. Some limited examples of these are

shown below which are contained in the EU_EMIR_EligibleCollateralEnum

list:

EU_EMIRTypeA-Denotes Cash in the form of money credited to an account in any currency, or similar claims for the repayment of money, such as money market deposits.EU_EMIRTypeB- Denotes gold in the form of allocated pure gold bullion of recognised good delivery.EU_EMIRTypeC-Denotes debt securities issued by Member States' central governments or central banks.

The cardinality for these enumeration lists (0..*) denotes that multiple values can be provided so several categories can be applied to a line of data expressed in an eligibility profile.

The final attribute in CollateralTaxonomyValue,

nonEnumeratedTaxonomyValue, offers additional data expression outside

of the listed taxonomy values, for use when a taxonomy value is not

enumerated in the model.

There are conditions associated to the use of the data attributes within

CollateralTaxonomyValue to ensure correct use of the data. These

conditions enforce the specified regulatory enumerated list to match the

taxonomy source. Therefore as an example you can only specify a category

from the EMIR enumerations list if the taxonomy source is

EU_EMIR_EligibleCollateralAssetClass

Maturity Profiles (Used within Asset Criteria)

The expression of collateral life span periods and specific maturity

dates is a common eligibility characteristic and may be needed for

determining other key collateral treatments such as haircut percentages.

The CDM has various approaches for representing assets maturities, they

are data attributes within the data type AssetCriteria as follows:

maturityType- Allows specification of the type of maturity range and has the following enumerated values:- Remaining Maturity

- Original Maturity

- From Issuance

maturityRangeAllows filtering on the underlying asset maturity through definition of a lower and upper bound range using data typePeriodRange. UsingPeriodBoundfor both ends of the scale you would need to specify the period, for example:lowerBound1Y , representing one year using thePeriod>periodMultiplier1 and periodPeriodEnumYupper bound5Y, representing 5 years using thePeriod>periodMultiplier5 and periodPeriodEnumY- In addition

PeriodBoundhas the inclusive boolean to indicate whether the period bound is inclusive, e.g. for a lower bound, false would indicate greater than, whereas true would indicate greater than or equal to.

A combination of these data attributes combined allows specificity of the maturity profile of collateral asset types and definition of a range that would sit alongside the other asset data criteria. Multiple maturity ranges can be listed for and associated to one asset type, varied collateral treatment haircuts can then be added to each of the ranges, this would be a common feature of a collateral eligibility schedule especially if there is an uncleared margin rules regulatory requirement.

Product Identifier (Used within Asset Criteria)

The CDM model as described throughout this guide will allow the user to

define collateral assets through the granular structure of the

AssetCriteria, but we must understand that expression of asset details

for eligibility purposes can take other forms across the universe of

collateral, for some processes there is a requirement to use certain

product identifiers. Data type productIdentifier can be used to

express specific instrument identifiers such as ISINs, CUSIPs etc. There

is a section within the CDM documentation that covers this area of the

model, this can be found in the following link

products-with-identifiers-section.

Listing (Used within Asset Criteria)

Additional details may be required to describe asset characteristics

related to a securities financial listing, exchange, sector or specified

indices, if relevant these are used to express eligibility details in

documentation and collateral profiles. The data type listing

ListingType contained within AssetCriteria can be used to

specification such listing criteria. This expands to three attributes

that can be used individually or together :

- exchange string (0..1) Represents a filter based on the primary stock exchange facilitating the listing of companies, exchange of Stocks, Exchange traded Derivatives, Bonds, and other Securities.

- sector string (0..1) Represents a filter based on an industry sector defined under a system for classifying industry types such as 'Global Industry Classification Standard (GICS)' and 'North American Industry Classification System (NAICS) or other related industry sector reference data.

- index Index (0..1) -- Represents a filter based on an index that measures a stock market, or a subset of a stock market. The `Index` data type can be used in the CDM to define an index in terms of a `ProductIdentifier' and an enumeration identifying the index constituent type.

Using The CDM Data Representation to Construct Eligible Collateral Information

This user guide provides an overview of the data available to represent details for expressing eligibility inclusive of the asset criteria, issuer criteria and the collateral treatment inclusion rules, valuation percentages and concentration limits. However, a combination of how the data is represented and structured will determine specific outcomes.

The data can be specified and organised as a list of attributes, such as descriptive details of the asset and the issuer, to identify the makeup of collateral.

This list can be made up of multiple attributes from both the asset or

issuer criteria and be grouped together. Items listed in this way using

the same level in the CDM are defined as an 'and' relationship. However,

opportunities exist in the CDM data structure to extended lists within a

list and add another level to both asset and issuer criteria which will

operate as an 'or' relationship. An example of this would be within data

type AssetCriteria there is an option to define a

denominatedCurrency (0..*); this data attribute with an open

cardinality allows for a definition of a list of currencies and

describes where a 'or' relationship exists.

Each list combination identified in this way can then have specific treatment rules applied to it.

For example, a simple list can be constructed as follows:

AssetCriteria>

- collateralAssetType>assetType: CASH

- denominatedCurrency: USD

And then the following treatment applied to the list

Treatment>

- isIncluded: TRUE

- haircutPercentage: 0.005

The outcome is- USD CASH IS ELIGIBLE AT 99.5% VALUE/ or WITH 0.5% HAIRCUT

To extend this example further a digital JSON output extract of the same details is show here:

{

"criteria": [{

"asset": [{

"collateralAssetType": [{

"assetType": "CASH"

}],

"denominatedCurrency": [{

"value": "USD"

}]

}],

"treatment": {

"haircutPercentage": {

"haircutPercentage": 0.005

},

"isIncluded": true

}